Uber Freight’s new report outlines roadmap for nationwide electric truck deployment

To drive down trucking emissions and move goods effectively and efficiently, we must strategically electrify local and interstate hauls. The United States has over 4 million heavy-duty trucks that travel over 177 billion miles and create over 260 million tons of greenhouse gas emissions per year, currently representing 8% of global emissions. According to the U.S. Federal Highway Administration, freight activity is expected to grow by 50% by 2050. Emissions regulations from federal and state governments are also steadily advancing, creating further urgency for decarbonization.

Commercial electric trucks are already here and present a promising opportunity to decarbonize the freight industry. However, given the lack of public charging stations and limited range, there are many challenges and scenarios to consider on the path to a more sustainable freight ecosystem. Uber Freight’s network insights hold critical information that can empower the ecosystem to overcome these obstacles.

Uber Freight envisions a future of optimized clean transportation. That’s why we announced our commitment to shift 80% of our global brokerage shipments to clean transportation by 2040. Underpinning this promise, we announced today a collaboration with Greenlane that will accelerate the development and installation of public charging infrastructure for Heavy Duty Battery Electric Vehicles (HDBEVs).

Our latest initiative is the unveiling of new research that reveals a roadmap for the thoughtful deployment and adoption of electric trucks at scale. Utilizing our vast network data, we analyzed 500,000 dry van loads that are representative of US freight movements and developed a model for the optimal development and deployment of charging stations across large markets and strategic freight corridors to meaningfully address sustainability within the freight industry. Our analysis builds on announced regulations such as the Inflation Reduction Act, the proposed EPA Clean Air Act, and the Advanced Clean Trucks rule which has been adopted in several states.

Among the key findings of the research are:

Local hauls in large markets can be rapidly electrified and should serve as the starting point for deployment.

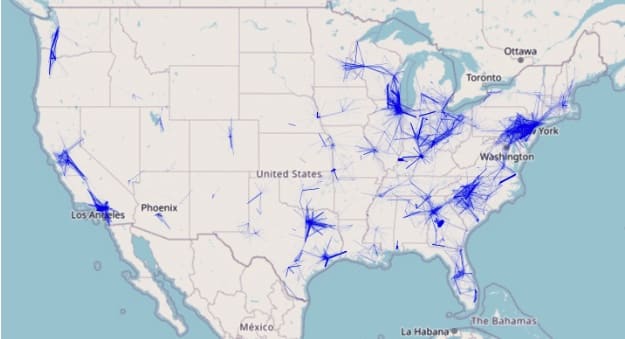

- Our research suggests that starting with local hauls is a good first step toward electrification due to the limitations of today’s charging infrastructure. If charging stations are located strategically, only a few stations are needed in each market to accelerate electric truck adoption.

- Markets like Los Angeles, Ontario, Atlanta, Dallas, and New York are strong early candidates. For example, in Dallas / Fort Worth: 10 charging stations are enough to provide early adopters with access to most local loads, accounting for 95% of local freight miles.

- Optimizing truck charger locations remains a complex task with many variables, including shippers’ locations, grid readiness, throughput time-of-day, locations of truck depots, and land availability.

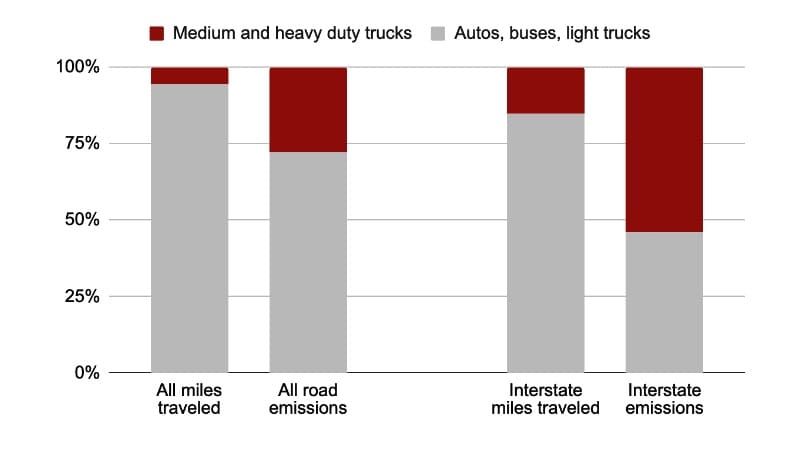

- Although they account for a quarter of all freight loads in the U.S., local hauls (those less than 150 miles) account for a small fraction (3.2%) of the miles traveled. Therefore, electrifying the interstate system, which carries more than half of all trucking miles, is critical to achieving a meaningful reduction in freight emissions.

Interstate electrification is key to driving meaningful change.

- Interstates represent 1.2% of total roadway length in the U.S. but carry 55% of freight miles.

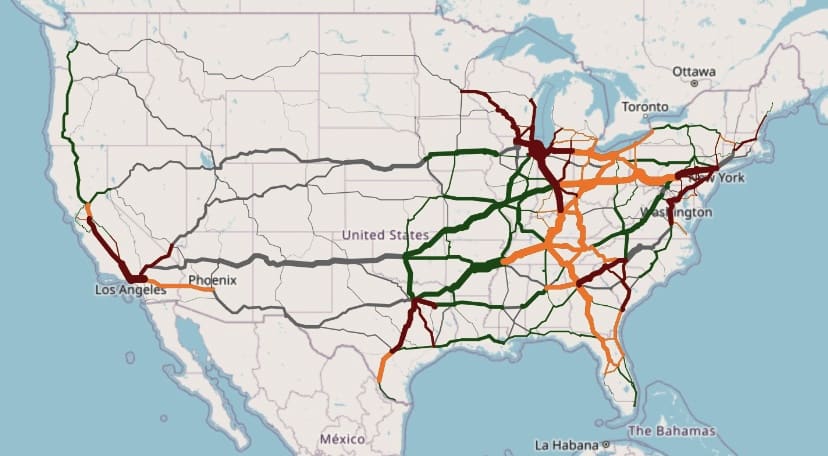

- Long-distance freight electrification requires heavier investments, but will likely have higher ROI because higher mileage means greater asset utilization. Initial long-distance deployment is most likely to happen on busy, but short interstate corridors.

- Currently, most heavy-duty electric trucks have a maximum range of 200 miles, and chargers are generally not available along the interstate system. However, if OEMs are able to double the range to 400 miles in the coming years, and chargers become more available on a given lane, for example, 9 chargers per 1000 miles, then two thirds of all heavy-duty loads on that lane could be addressable by ETs, accounting for more than half of the freight miles.

Even with a limited truck range of 300 miles, over 75% of truck miles in the U.S. can be electrified – but only if charging infrastructure is available ubiquitously.

- As electric trucks scale, the power capacity of charging stations will become the largest constraint, even for local freight. North America’s grid must be prepared to add significant capacity to address new truck electricity demand.

- Research estimates that in the next decade, by 2035 North America’s grid must be prepared to add 230 TWh of new truck electricity demand, including power for nearly 150,000 fast public chargers and 860,000 depot chargers.

- Shipper facilities might be good candidates for doubling as charging stations. With additional charging stations at shippers’ facilities, our results show that charging at facilities can increase the number of addressable loads by about 12%, and increase the number of addressable miles by about 8%. Public and shared chargers can complement private ones and accelerate adoption by eliminating the financial barriers for carriers that cannot invest in private chargers.

- Our research reveals the regions and corridors that are prime for early electrification, and uncovers how infrastructure development is expected to progress over time. To optimize market penetration, the first stage of deployment will likely see electrification along busy, but relatively short, interstate corridors like the Texas Triangle lanes connecting Dallas to Houston and San Antonio, and the I-5 corridor between Los Angeles and Stockton.

- In later stages, the majority of the interstate system in the eastern US should be electrified.

Insights like these are critical for optimizing and accelerating the necessary rollout of electric trucks to further decarbonize supply chains. With a rich dataset of $18B of freight under management (FUM) and expertise in data analytics and freight sustainability, Uber Freight can improve reliability and cost-effectiveness for shippers by optimizing routes, ultimately maximizing the utilization of electric trucks across entire networks. We are uniquely positioned to help the industry navigate the logistical complexities of integrating and deploying electric vehicles at scale due to our network size, industry-leading marketplace technology, and partnerships and pilot programs with EV infrastructure leaders, truck developers, and carriers in our network. The research was also independently reviewed and validated by the North American Council for Freight Efficiency (NACFE), a non-profit organization that works to promote the development and adoption of cost-effective, environmentally beneficial, and efficiency-enhancing technologies, services, and operational practices in the North American freight industry.

For further analysis from Uber Freight about the roadmap to electrification, download the full white paper.