Are current spot rates sustainable?

Carriers’ operating costs show they’re not

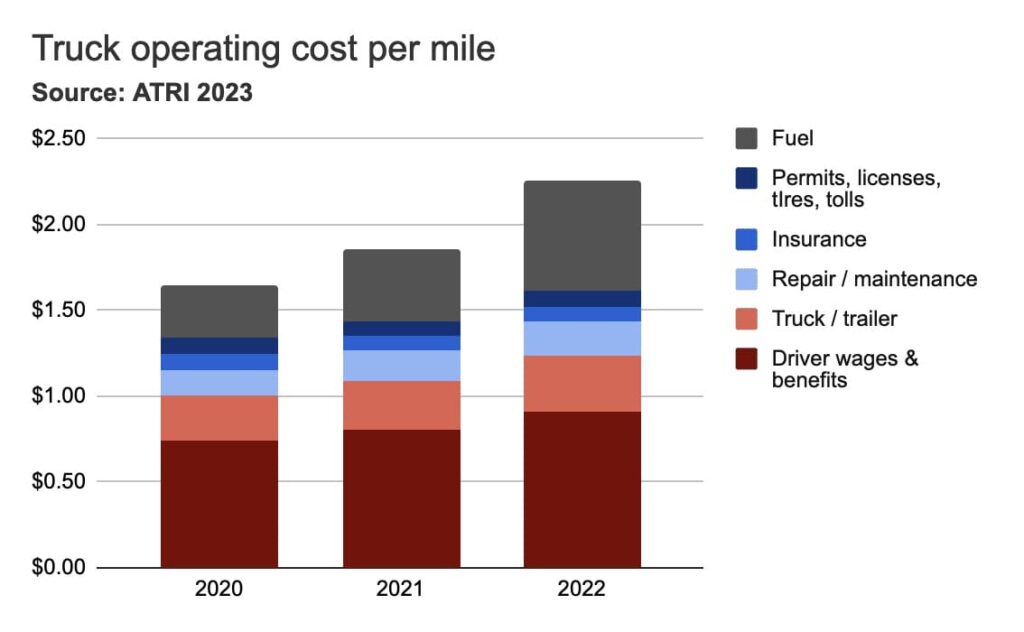

The cost to operate a truck surged by 21% in 2022, according to the American Transportation Research Institute (ATRI). In a report published in June, ATRI concluded that costs rose above $2.00/mi for the first time, and by a significant margin. The increases were mostly driven by fuel, driver wages, and rising equipment costs. In the truckload sector, the operating cost was $2.15/mi.

This raises an important question: are current spot rates sustainable?

While the cost per mile (CPM) is calculated based on all the miles driven by a carrier, carriers are usually compensated for loaded miles only. Empty miles, also known as deadhead, add to the costs of trucking. Therefore, if we want to compare costs to freight rates, we need to calculate the cost per revenue mile (CPRM).

According to the ATRI survey, 15.4% of the miles driven by fleets were non-revenue generating, or deadhead miles. This implies that the CPRM for truckload carriers was about $2.54/mi in 2022. In comparison, the average dry van spot rate was $2.49/mi in the last quarter of 2022, slightly lower than this CPRM.¹

To make things worse, spot rates continued to decline in the first half of 2023, while operating costs remained elevated. Therefore, the gap between carriers’ costs and revenues increased further to levels unseen even during the 2019 freight recession.

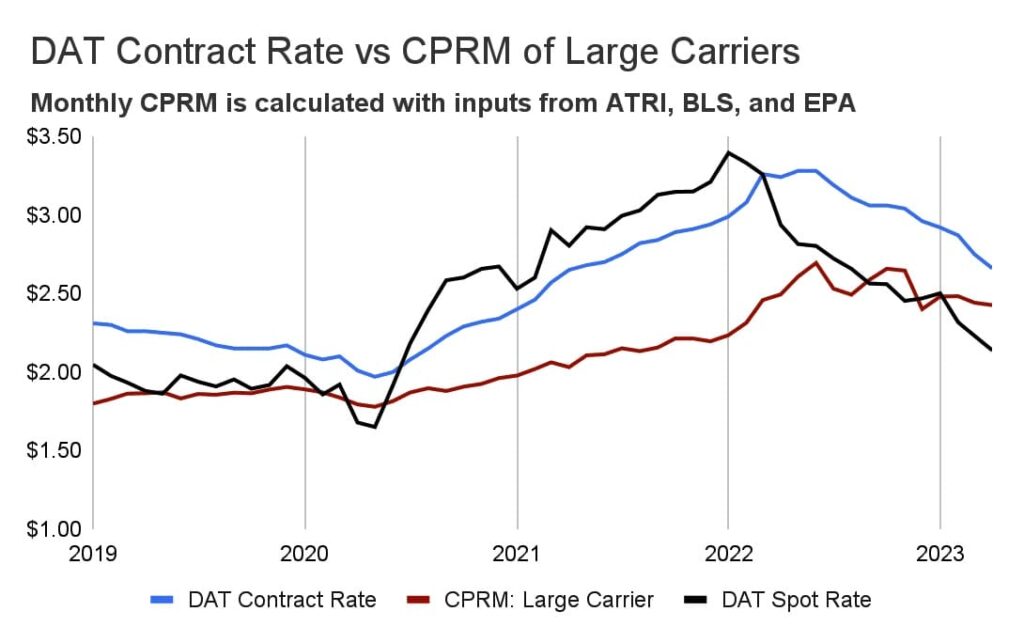

To demonstrate this, we augmented the ATRI findings with data from the Bureau of Labor Statistics (BLS) and Environmental Protection Agency (EPA) in order to calculate the CPRM by month, and compare it to spot rates.²

The current spot market is unprofitable, even to large carriers

We first considered the operating costs of large carriers, which are about 3.3% lower than those of small carriers, according to ATRI ($2.223/mi compared to $2.300/mi). The results indicate that spot rates were $0.29/mi lower than the CRPM in April 2023 ($2.14/mi vs $2.43/mi). These large carriers are still able to make positive margins on contract freight (about 9%). However, these margins are much thinner than where they were a year ago (about 30%).

These results might not apply to all carriers, because the operating costs and rates depend on the average length-of-haul of each carrier. However, they provide directional insights on an aggregate level.

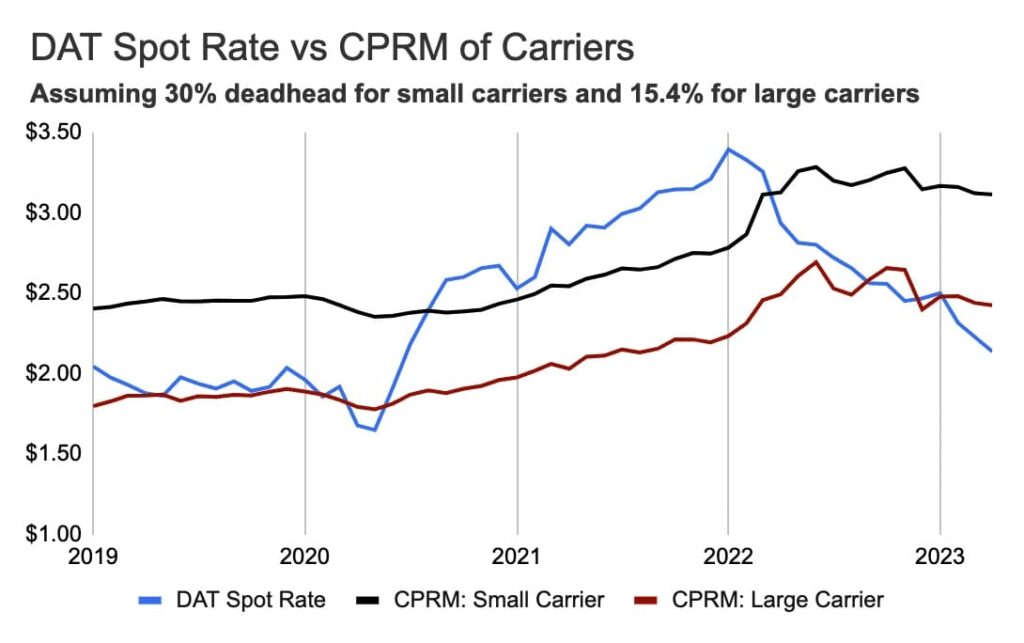

What about smaller carriers?

The current environment is definitely more challenging for smaller carriers. First, the operating costs of these carriers are higher. For example, many do not have access to wholesale diesel prices. In addition, their insurance and maintenance costs are also higher, according to ATRI. More importantly, these carriers might neither have the scale nor capabilities to optimize their operations, and therefore, drive more empty miles. Finally, these carriers are more dependent on the spot market, where rates have fallen more sharply in the past 18 months.

The figure below compares the operating costs of a large carrier to a small one with 30% deadhead in its network. Under these assumptions, the smaller carrier pays about 28% more per revenue mile than a large carrier does. The CPRM of this carrier would also be 46% higher than the current spot rates (including fuel).

What’s next?

Based on the above results, one can only conclude that the current spot rates are not sustainable. Keep in mind that the above costs only include the marginal costs of operating a truck, and therefore, they do not even include the costs of carriers’ facilities, dispatchers, and management, all of which can exacerbate carriers’ already negative margins.

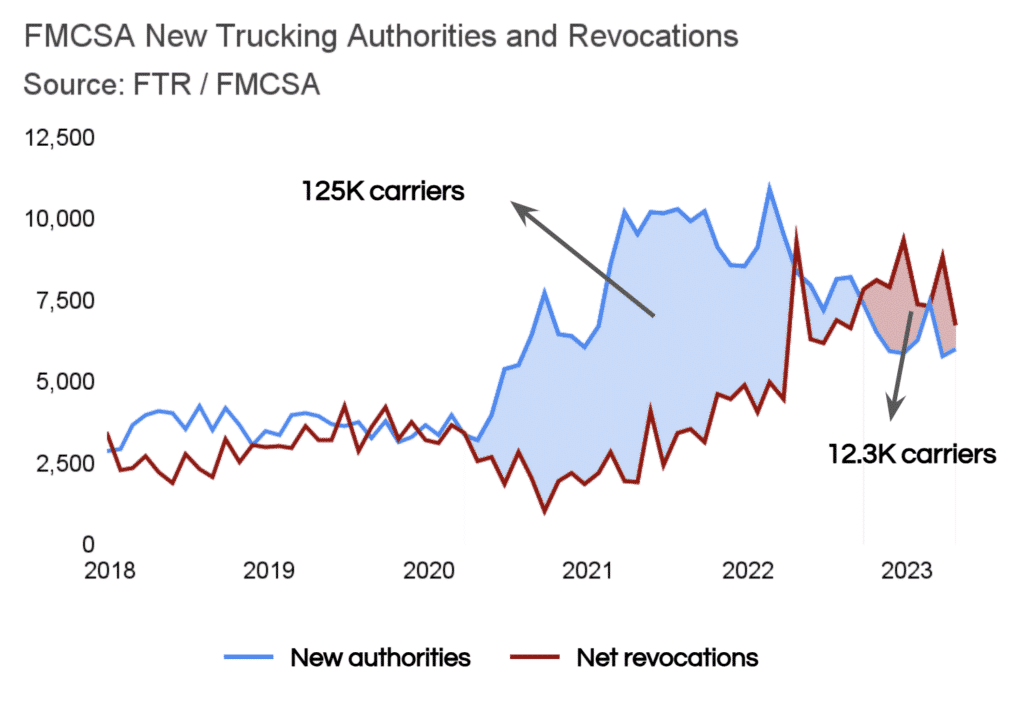

These negative margins indicate that capacity correction should be underway. Data from the Federal Motor Carrier Safety Administration (FMCSA) show a record number of revocations of trucking operating authorities in the past 8 months. This has resulted in a reduction in the net carrier population by 12.3K carriers. We expect this trend to continue in the coming months, until supply returns to levels that are consistent with the current demand.

What does it mean for carriers and shippers?

Shippers

Many shippers are currently looking to benefit from the depressed spot market. This should be fine, as long as they do not commit to rates that are unsustainable. For example, shippers must be careful not to negotiate contractual rates that are below carriers’ operating costs, because this will put their service levels at risk when the market recovers.

Carriers

Carriers of all sizes must watch their operating costs and empty miles. They can also reduce these expenses with network optimization, and benefit from Uber Freight’s bundles and personalized rankings to cut their deadhead.

With the Uber Freight marketplace, shippers and carriers have the transparency needed to plan and execute around market fluctuations, price loads dynamically, and continuously improve operational efficiencies across supply chains.

¹ According to UF’s analysis of DAT data.

² We estimated the month-over-month change in each cost component using relevant adjustments from the Producer Price Index (PPI) and Consumer Price Index (CPI) of different commodities, drivers’ earnings data, and diesel wholesale and retail prices.