How Uber Freight’s shippers navigated the soft market

By: Mazen Danaf, Staff Applied Scientist at Uber Freight

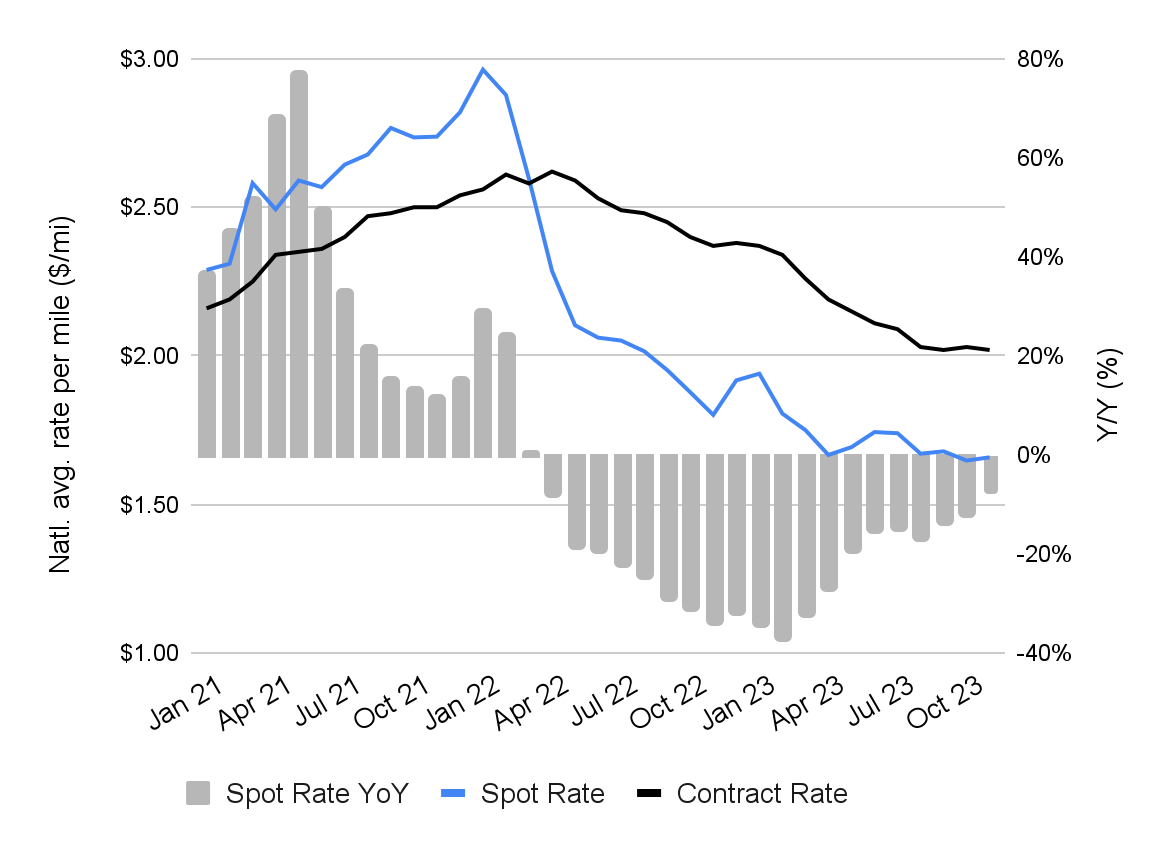

We’re through the very earliest days of 2024, and so far the market is soft—consistent with the past year. In 2023, spot rates fell about 21% from their 2022 levels, and contract rates fell 15%. While stagnant demand was not good news to most shippers, it provided a much-needed breather for supply chain professionals, along with lingering excess supply, driving rates lower and service levels higher. Some shippers chased after cost savings, particularly in the spot market, while others chose to prioritize service and carrier relationships in preparation for the next tight market.

That tight market might be coming in 2024. What does that mean for you? It depends on how you approached the soft market of 2023.

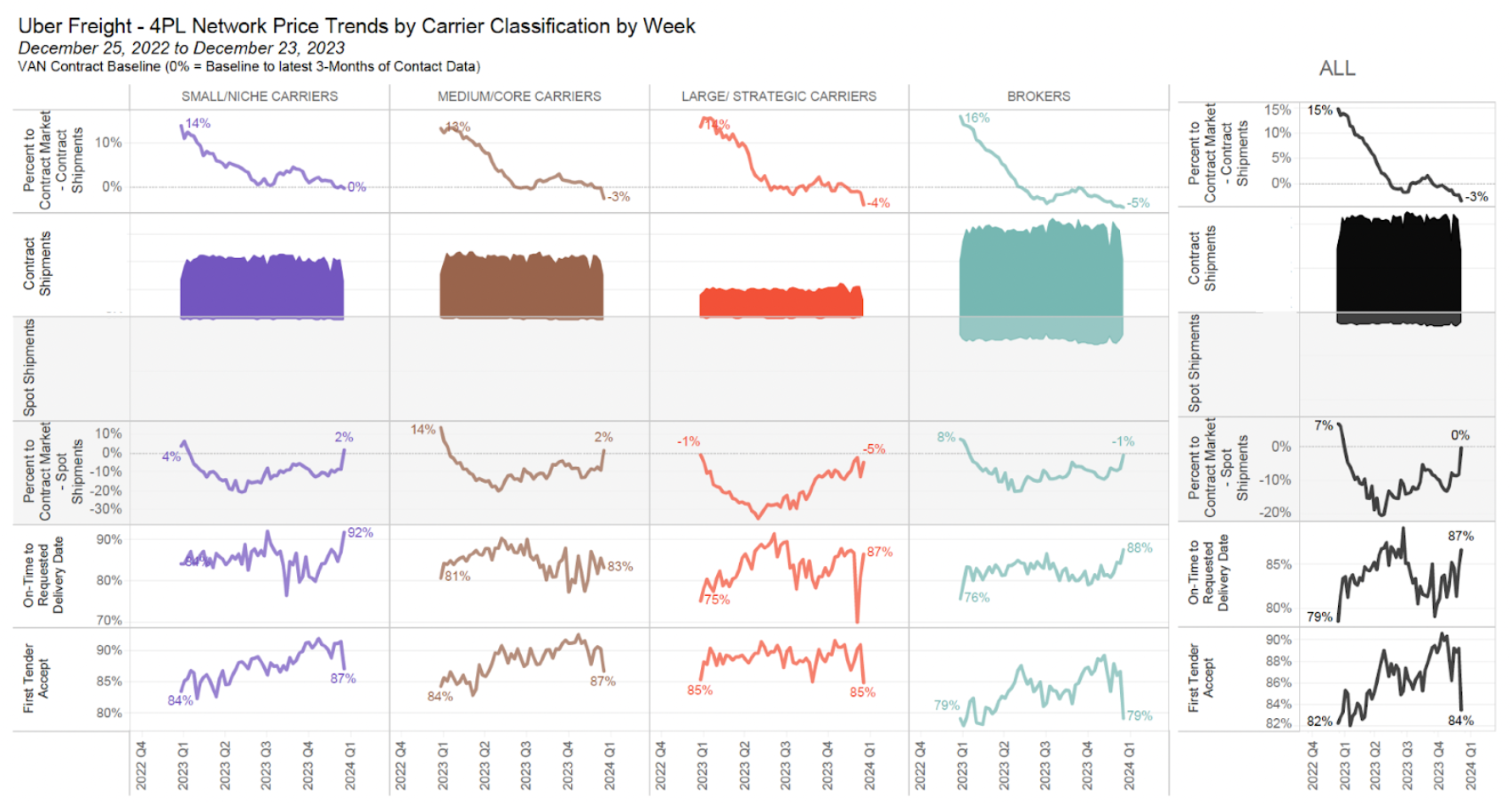

Using our vast dataset of truckload shippers in the US, we developed a data-driven model to classify shippers into five personas, depending on how they navigated the soft market in terms of their costs, routing guides, and service levels. We summarize the key performance metrics of each shipper persona below—and took a look at what their 2023 strategy could mean for the coming year.

The Strategist

Shipper size: Large (18% of Uber Freight’s TM shippers)

These shippers chose to prioritize long-term partnerships with large and strategic carriers. They did so by reducing their brokered volume, and cutting the number of carriers to focus on large incumbents and strategic partners, each of which moved on average a thousand loads per year for these shippers. In 2023, they prioritized service and relied minimally on the spot market. On average, spot-FAM shipments constituted only about 6% of their volume. Their average first tender acceptance (FTA) rate rose significantly from 80% in 2022 to 92% in 2023. Despite focusing on service, these shippers still saw significant cost savings, averaging 14 cents per mile on truckload rates.*

The Economist

Shipper Size: Large (38%)

These were more cost conscious than the former group. They were able to realize higher savings and still achieve moderate improvements in service. They tapped into the spot market more (about 9% of their shipments) and were able to achieve an $0.18/mile reduction in rates.* Their FTA rose from 81% in 2022 to 89% in 2023. These used brokers for almost half of their loads, and small and medium sized carriers for the other half.

The Opportunist

Shipper Size: Small-Medium (7%)

These small- and medium-sized shippers were able to achieve the best savings by tapping aggressively into the spot market and broker networks, which they used for three quarters of their shipments. They were able to achieve savings up to $0.28/mile from 2022.* Unlike other shippers, they increased their share of spot freight from about 28% in 2022 to 43% in 2023, to benefit from the large gap between spot and contracted rates. While all other groups reduced the share of brokers in their overall networks, these aggressive shippers increased their share by 10%, and reduced their reliance on large carriers, which pushed back against aggressive cost cuts. These shippers were not as sensitive to service, and had the lowest FTA of any group at only 68%, which was still a 15% improvement from last year.

The Stalwart

Shipper Size: Small-Medium (29%)

Like the above group, these small- and medium-sized shippers used brokers for three quarters of their loads, and tapped heavily into the spot market (~23% of their shipments). However, they chose to prioritize service over cost, by slightly reducing the share of spot in their networks from 2022. With the help of brokers, these shippers were able to achieve an impressive FTA of 93%, while at the same time cutting their truckload rates by $0.18/mile from 2022.*

The Traditionalist

Shipper Size: Small-Medium (7%)

These shippers maintained intimate relationships with niche and small-sized carriers, which either provided dedicated services or guaranteed high levels of service. Since these niche carriers provided three quarters of the needed capacity, these shippers did not tap into broker networks. These shippers also went all-in on contracted freight, and only tapped into the spot market for 4% of their loads. Therefore, they had the highest level of first tender acceptance of all groups (~94%), but saw the lowest amount of savings compared to 2022, at only $0.10/mile.*

As expected, cost savings in 2023 were highly correlated with shippers’ use of the spot market and of broker networks, and negatively correlated with increased reliance on large strategic carriers. Meanwhile, service-level improvements were highly correlated with the transition towards large and strategic carriers, and the reduction in a shipper’s carrier base to limit it to a few high performers.

What to expect in 2024

All shipper groups largely benefited from the soft market in 2023, either by achieving large cost reductions, improving their levels of service, or a combination of the two. As we head into 2024, we expect the soft market to persist at least through the first half of the year. However, the outlook is less certain in the second half, where either a recovery in demand or supply contraction can turn the tide.

When this happens, shippers who choose to prioritize service and strategic relationships can start to reap the benefits of their investments. On the other hand, those who benefited from low spot rates and negotiated aggressive contracts should start to plan their strategy for the upcoming year:

- The Strategist: The strategic partnerships should offer some protection in case the market tightens, especially that these shippers did not realize a lot of cost savings. Lock rates with long-term contracts.

The Economist + The Stalwart: Prepare for a potential market turn. Look at your network and identify areas of vulnerability in case the market tightens. Protect against those using either short-term contracts or index-based pricing. - The Opportunist: You reaped the rewards of the extended soft market, but now it’s time to start rethinking your strategy. Keep a close eye on early indicators of a market shift. Build relationships with carriers or brokers to start prioritizing capacity over cost.

- The Traditionalist: There are little concerns of deteriorating service levels, but there might be still some untapped savings, especially if the market remains soft for an extended duration.

No matter what strategy shippers took in 2023, technology should be a key component of 2024 planning—and beyond. With a TMS, shippers can have an always-on, 360 degree view into their shipping operations. It’s a tool that can identify opportunities to save time and money by streamlining processes, leverage real-time analytics to spot and mitigate possible service disruptions, and much more. Learn more about how a TMS can help you ship faster and smarter—no matter the size of your business or how much freight you’re moving.

To gain more insights from Uber Freight’s analysts on the year ahead, sign up to attend our Q1 2024 Market Update & Outlook Webinar.

*These numbers are the conclusion of studies on internal Uber Freight data.